Understanding the Tokenomic Model of IndoorAI

IndoorAI stands as a revolutionary AI-powered DeFi protocol that transforms yield generation by combining long-term tokenomics, GameFi mechanics, and autonomous AI investment strategies. Its sustainable structure revolves around a carefully balanced token distribution model and multiple profit-generating loops designed to fuel consistent ecosystem growth.

1. Burn-to-Yield: Long-Term Yield with Deflationary Impact

At the heart of IndoorAI is the “burn-to-yield” model. When users deposit their IDA tokens, the system burns them permanently. This process not only reduces the circulating supply but also activates a continuous daily yield cycle that lasts for 5 to 7 years. This long-term yield mechanism is stable and predictable, allowing users to plan their financial strategy securely. More importantly, it generates yield without relying on inflation or new token issuance—creating real deflationary pressure and sustainable value.

2. GameFi Integration: High-Risk, High-Reward Incentives

IndoorAI adds a layer of gamified incentives through GameFi. Users can choose to participate in PvP battles using their earned yield. Winners receive additional token rewards, which are then automatically burned—amplifying deflation and increasing demand. GameFi doesn’t just offer entertainment; it actively contributes to token utility and creates a reinforcing loop that keeps users engaged while limiting circulating supply.

3. AI Management: Smart Reinvestment for Real Yield

For users seeking automated profit, IndoorAI’s AI Management system allows yield to be reallocated into optimized strategies such as DeFi farming, staking, or derivatives trading. These profits are then recycled back into the protocol’s treasury to support long-term yield distribution across the system. By eliminating the need to mint new tokens, this model ensures that IndoorAI can scale sustainably without sacrificing economic integrity.

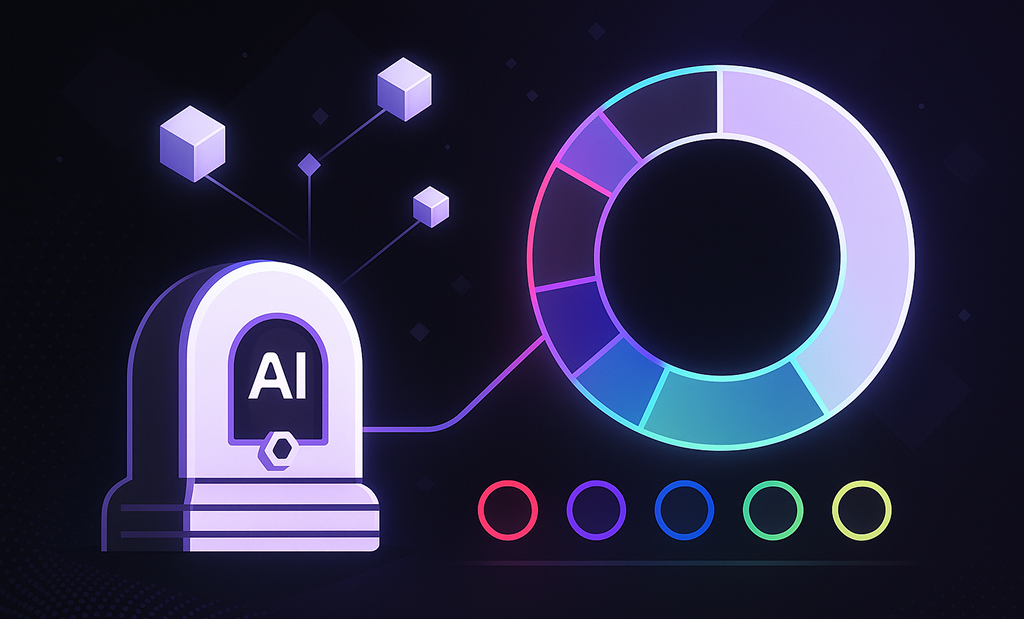

4. Token Distribution: Balanced for Growth

The tokenomics are designed with longevity and ecosystem health in mind:

- 45% of IDA tokens are allocated for AI ecosystem rewards.

- 15% for the team and advisors, ensuring long-term commitment.

- 10% each for liquidity provision, marketing & growth, and public sale.

- 6% reserved for strategic reserves.

- 4% allocated for private sale investors.

This distribution ensures that rewards, development, and market adoption are supported while keeping speculative pressures under control.

Conclusion

IndoorAI is not just another DeFi platform—it’s a self-sustaining economic engine. With burn-to-yield at its core, strategic GameFi integration, and AI-driven reinvestment, IndoorAI sets a new standard for tokenomics that are sustainable, scalable, and built for the future of decentralized finance.

Let me know if you want a matching infographic or visual asset created for this explanation.